The newest phase in Serendra, Fort Bonifacio is The Aston, where city living meets natural beauty in perfect harmony. A high-rise condo located in a suburban-style neighborhood, The Aston is 2.3 hectares wide but most of the area is devoted to open space that will be designed according to the landscape of Serendra. At the center of the open area will be an expansive swimming pool, lots of water elements, and themed amenities like river boats, hanging bridges, forest walkway, and tree houses. Recreational areas such as a day care center, jogging trail, video game room, and mini theater serve as a space for the residents to come together and spend time as a community.

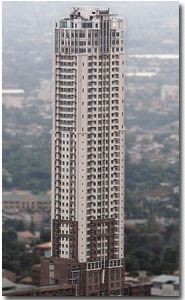

The building itself is 35 storeys tall and has studio (42 to 54 sqm at Php 3.2 – Php 4.6 M), one bedroom (55 to 69 sqm at Php 4.2 to Php 5.5 M), two bedroom (82 to 135 sqm at Php 7.5 to Php 9.1 M), three bedroom (105 to 152 SQM at Php 9.4 to Php 10.9 M), and a special three bedroom unit with two levels (160 to 161 Sqm at Php 14.2 to Php 14.3 M)

For more information, visit the Alveo Land website.